Understanding Household Responses to Inflation: Insights from Randomized Controlled Trials after High Inflation

GACR 25-17769S

2025-01-01 - 2027-12-31

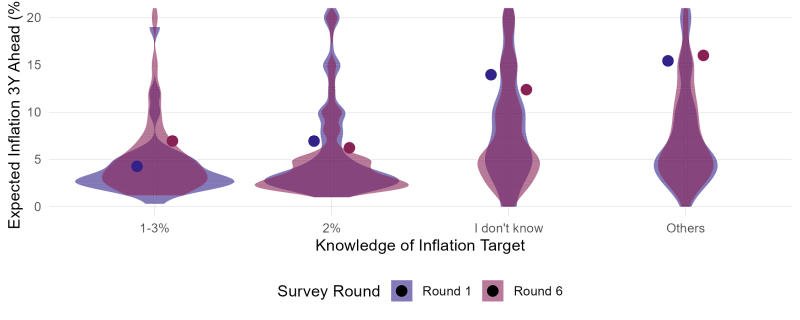

Our research proposes three randomized controlled trials (RCTs) to examine the intricate relationship between inflation expectations, household behavior, and central bank credibility in the context of recent double-digit inflation in the Czech Republic. Our goal is to focus on the causal effects of the news about inflation and the communication of monetary policy on inflation expectations and household decisions. By conducting these experiments in an environment marked by recent inflationary pressures, our study will provide insights into central bank communication when the central bank seeks to restore its credibility and stabilize inflation expectations at the inflation target. Furthermore, we aim to uncover whether there is a systematic difference in the reactions of households depending on their liquidity constraints and wealth to enrich the growing literature pointing towards the importance of household heterogeneity on the transmission of monetary policy and the effects of policy shocks.